Dodging the Bad Trades

Look, let's cut the crap: every indicator throws bad signals, and some are straight-up traps laid by market manipulators to bleed you dry. It's the game, and you're losing if you're not playing smart. But you're not helpless—yet. You dodge those losses with a solid strategy, a damn good grip on your emotions, and a brain that's actually switched on.

Don't just take our word for it, though. You need to backtest this indicator yourself—now. Find those winning entry spots, nail down your strategy, and stop trading like a blindfolded monkey wandering into a bear trap. This ain't a fairytale, and time is ticking. It's about taking control and knowing your tool—before it's too late. To help you stay sharp and stop throwing money away, we've listed a few common mistakes that lead to losses, so you can avoid stepping into those traps yourself.

Now, some traders might whine that these rules are too much to remember and follow. Well, welcome to the real world. Take it or leave it. If you want to succeed in trading but can't handle the rules and change your damn trading style, you're doomed. We'll see you flipping burgers at McDonald's for minimum wage.

Patience Pays

Impatience in trading is a costly mistake. Always wait for the candle to close. Last-second reversals can derail your trade. Allow your patterns to fully develop. If you find yourself rushing, step away from the charts. It's the best way to safeguard your capital.

Don't Trade on Ego

Never blindly trust any signal. Discipline is key—stick to your strategy and rules. When a trade seems like a guaranteed win, be suspicious. It's likely a trap by market manipulators. Always maintain a healthy "too good to be true" mindset.

Chasing Kills

Resist the urge to chase trends. While it may seem tempting to jump on a moving market, it often results in trades reversing against you. Seasoned traders know when to cut their losses, but beginners tend to hold on, hoping for a reversal, which ultimately leads to account depletion.

Skip Open/Close Hours

Don't even entertain signals at market open or close. They're typically worthless due to low volume. This indicator excels with volume, not whispers. Get some well-deserved rest after the close, or indulge in a leisurely morning when the market opens. And for heaven's sake, stop trading every blip on the chart.

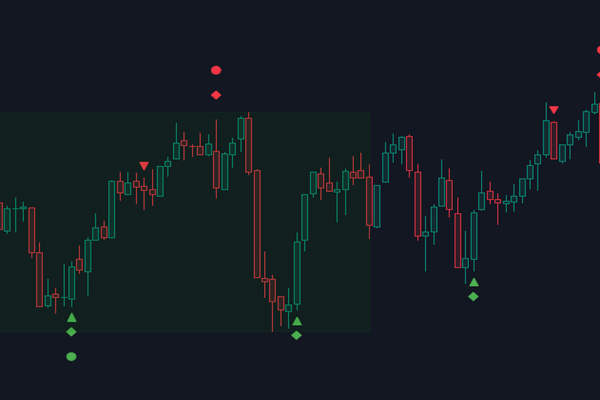

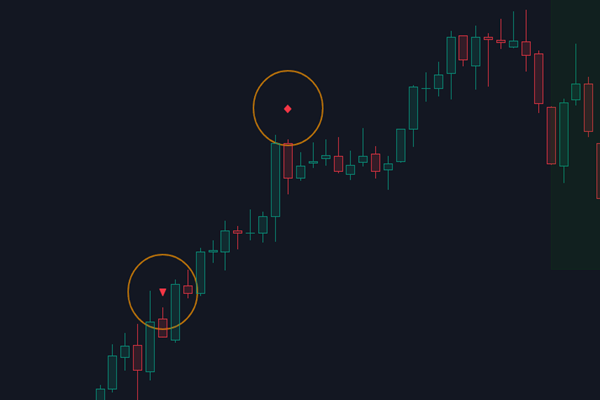

A Sign of Caution

When the triangle and diamond indicators spread apart, exercise caution. This divergence suggests the signal may be weak, as the confluences are moving in different directions. Traders should avoid such signals and prioritize those where the indicators are in close proximity.

Overly Smooth RSI

If the RSI trend is too smooth and a signal appears, that's a warning sign. It often indicates a continuation trend or a second wave, which can be risky. Traders should refrain from trading signals when the RSI trendline is overly smooth.

Beware Diverging Signal

Timeframe Conflict

Discrepancies in multi-timeframe confluence should raise a red flag. If trading on a 5-minute chart, verify alignment with the 1-minute chart. A 1-minute buy signal conflicting with a 5-minute sell signal demands careful risk assessment and order reconsideration.

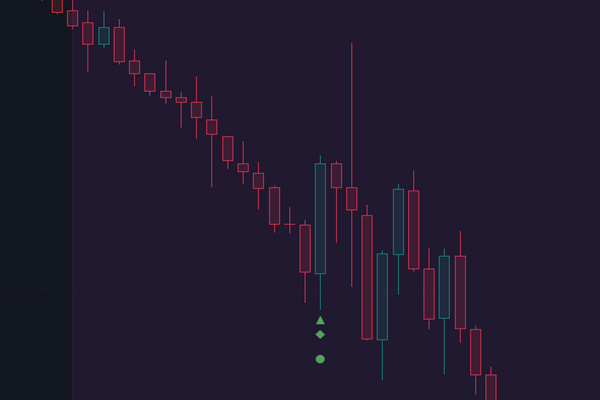

Skip or Pullback

Be cautious of sudden, extended spikes. These spikes often generate signals due to their rapid price action. When such a signal appears, consider either avoiding the trade entirely or waiting for a pullback to reduce your potential losses in case your stop-loss is activated.

Subscribe Now

Stop Wasting Time. Start Making Money.

Tired of getting screwed over by the market? Stop playing games with your hard-earned cash. This is your chance to finally get the tools and signals you need to succeed. For literally $1 a day , you can gain the edge professional traders use. Why wouldn't you give yourself this opportunity? Imagine the difference a single dollar can make to your future.

Subscribe now and start winning.

Free Trial

No Credit Card Needed

- 60 Days free trial

- Settings provided

- Alert trade function

- Easy setup

- Free lifetime updates

Monthly

- Settings provided

- Alert trade function

- Easy setup

- Free lifetime updates

- Access to training videos

- Cancel online anytime

Yearly

- Settings provided

- Alert trade function

- Easy setup

- Free lifetime updates

- Access to training videos

- Cancel online anytime